What's New in version 2009.1

Decision Manager version 2009.1 includes Verification – the ability to screen out selected applications and automatically decline them – without pulling a credit report. Read on for additional updates.

| • | Verification – Verification has been enabled in Decision Manager. Verification will automatically decline applications that meet the rule criteria established. See help topic on Verification for additional information. |

| • | Copy/Paste Functionality – The Term, Rate and Loan Amount matrices have been enhanced to support copying and pasting the body of a table. Prior to this enhancement, it was only possible to paste one cell at a time. Below are the requirements to use this function: |

| ► | Copying and pasting of data can only be done in the Loan Amount, Term, and Rate matrices |

| ► | The table must first exist before data can be pasted, so the axis must already be established before you can paste |

| ► | The matrix axis copy/paste functionality has not changed; changes must be made to the axis values one at a time |

| ► | The number of rows and number of columns must be at least as large as the source data; the paste function will not work if the source data in the clipboard is larger than the destination table |

| ► | To copy, select the desired data from an existing product matrix, right-click, and select copy (or press Ctrl+C) |

| ► | To paste, select the upper-left cell (starting point), right-click, and select paste (or press Ctrl+V) |

| • | Referral Reason Report – The Referral Reason report has been updated to include the report parameters in the header of the report. Report now includes credit union name, date range, state selected, and product. The report was also enhanced to run faster, correcting issues with the report taking too long to load or timing out. |

| • | Routing Audit Report – The Routing Report icon has been updated to display the routing rules of all products in the current environment with one click..A new Routing icon – Routing History – displays the previous routing established by the credit union. |

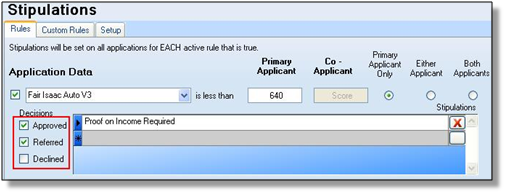

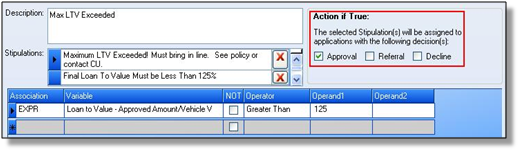

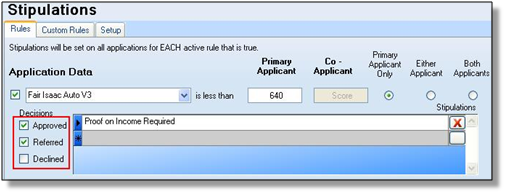

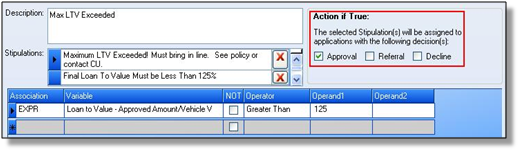

| • | Stipulations – The Stipulation Rules and Custom Rules screens now have options for indicating the decision types to which stipulations should be applied. The user can now select to assign a stipulation to an application if Approved, Referred or Declined (or all status) in Rules and Custom Rules. This means the user will not longer be required to add the Decision variable to each rule “AND Decision Equals Approve.” The stipulation rule “Time employed is less than” will no longer append the stipulation set by the credit union if the Employment Status in CUDL3 is Retired. If a credit union wants to set stipulations (such as Proof of Income) on retired applications, they should create a custom rule for this purpose. |

Page url:

https://decision.cudl.com/help/index.html?2009_1.htm