|

|

|

|

|

|

Enhanced Loan Amount Adjustments allows you to define cutoffs for Loan-To-Value Ratio (LTV), Debt-To-Income Ratio (DTI), and Payment-To-Income Ratio. These cutoffs are used to calculate alternate Maximum Loan Amounts. Whenever the Approved Loan Amount will exceed these maximums, the amount is reduced until it is within all three cutoffs.

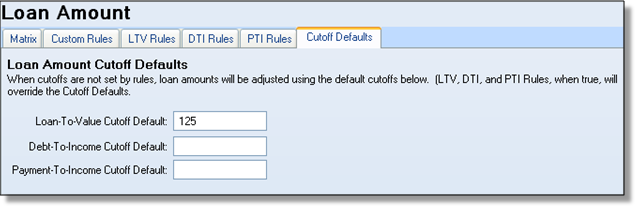

Cutoff Defaults

Use the Cutoff Defaults tab to set general cutoff for one or all of these variables. If the same cutoff applies to all applications, this is all that is needed. For example, if you never want the LTV to exceed 125% on any application, set the LTV Cutoff Default to 125.

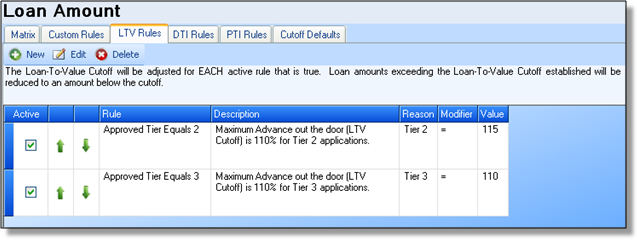

Cutoff Rules

The Rules tabs use Rule Editors to set cutoffs that are unique to each application. Although you set up Default Cutoffs with one parameter, you can still set up lower or higher cutoffs for applications that meet certain criteria. For example, you can create rules to set the LTV Cutoff to 115% or 110% - depending on the tier.

NOTE: Rules override Cutoff Default settings when true.

The above options make it possible to assign a different LTV Cutoff to each application. The same options are available for DTI and PTI cutoffs.

See also the following topics:

Page url: https://decision.cudl.com/help/index.html?enhanced_loan_amount_adjustmen.htm