|

2012.1 |

|

|

|

|

What's New in Decision Manager 2012.1?

Credit Bureau Failover

Decision Manager 2012.1 provides the long awaited feature of Credit Bureau Failover. Credit Bureau Failover allows you to create an automated process to failover to an alternate credit bureau when the applicant's primary credit bureau request fails or essential information is missing from the credit report.

In order to provide setup for Credit Bureau Failover, the previous single screen setup for Credit has been split into three tabs:

For a complete description of Credit Bureau Failover and the screen re-design, please refer to “Credit” under Product Setup in the Decision Manager Help Files.

New Variables

In support of Credit Bureau Failover, the following variables are now available. These variables are available even if Credit Bureau Failover is not being used. Complete definitions for these and all variables can be found in the Appendix.

| • | Credit Bureau Used for Decisioning |

| • | CB1 Score |

| • | CB2 Score |

| • | CB3 Score |

| • | CB4 Score |

| • | CB5 Score |

In support of Lending 360, the following variable was added. See full variable description in the Appendix

| • | Credit Request Only |

New Variables - added in 2012.0.1 release

Complete definitions for these and all variables can be found in the Appendix.

| • | Number of Unpaid Judgments |

| • | Number of Unpaid Tax Liens |

Credit Bureau Failover Results Displayed in CUDL3 and Lending 360

The manner in which credit bureau failover results are displayed in CUDL3 and Lending 360 is not controlled by Decision Manager. The information below shows the display method at the time of the 2012.1 Decision Manager release. Display in CUDL3 and Lending 360 may change after this initial release.

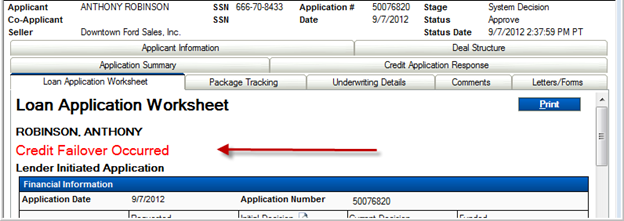

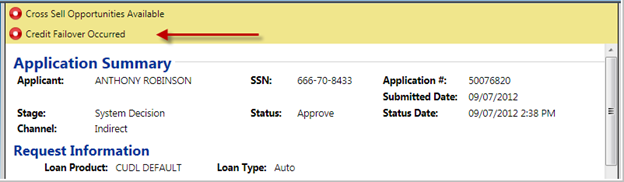

1. When credit bureau failover occurs, the alert “Credit Failover Occurred” is displayed in the application results. Below are examples from CUDL3 and Lending 360.

CUDL3 display of “Credit Failover Occurred” alert on the Loan Application Worksheet

CUDL3 display of “Credit Failover Occurred” alert on the Application Summary

Lending 360 display of “Credit Failover Occurred” alert on the Application Summary

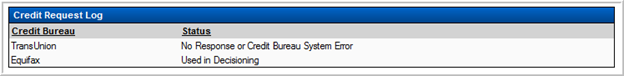

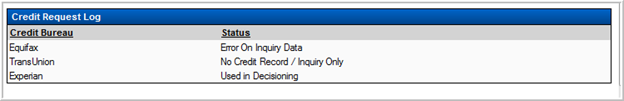

2. When credit bureau failover occurs, the reasons for failover are displayed in the application results. Below are examples from CUDL3 and Lending 360.

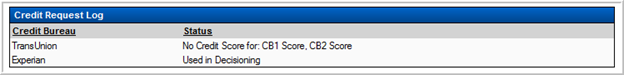

In CUDL3, a new section titled “Credit Request Log” shows the status of each credit bureau inquiry. For each credit bureau, the log identifies the failover reasons or indicates the credit bureau was “Used in Decisioning”. The examples below show the text that will be displayed for each failover reason.

In Lending 360, the credit failover reasons are displayed in the Application Summary > Decision History.

CUDL3 display of credit failover reasons

Lending 360 display of credit failover reasons

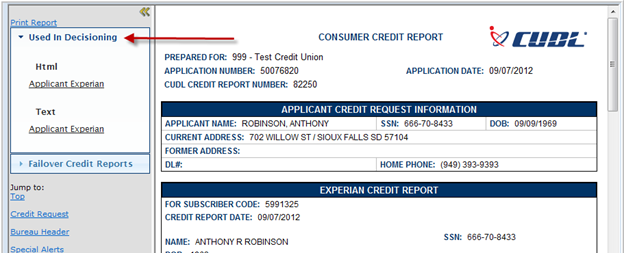

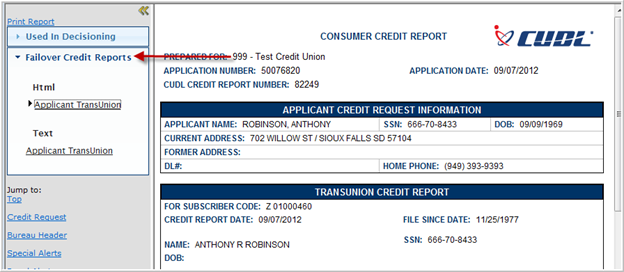

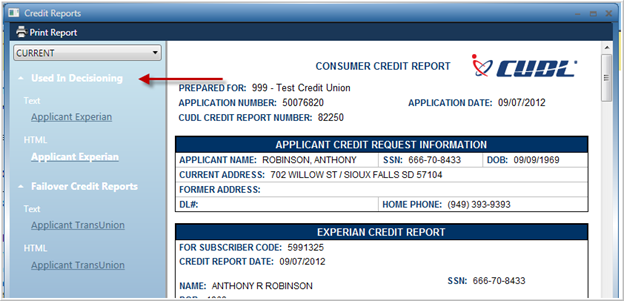

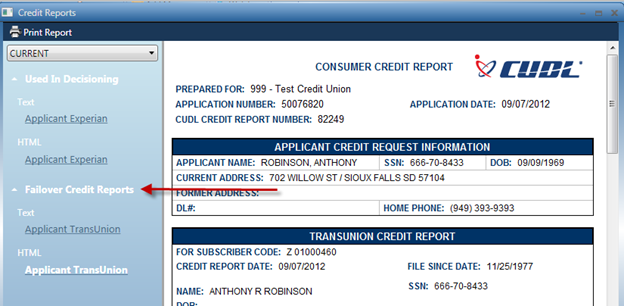

3. When credit bureau failover occurs, the credit reports from each credit bureau accessed will be available for display in CUDL3 and Lending 360. The credit reports are grouped into two sections:

| • | Used in Decisioning: displays the credit reports that were evaluated in the decision process |

| • | Failover Credit Reports: displays the credit reports that resulted in failover |

CUDL3 display of the credit reports used in decisioning

CUDL3 display of the failover credit reports

Lending 360 display of credit reports used in decisioning

Lending 360 display of failover credit reports

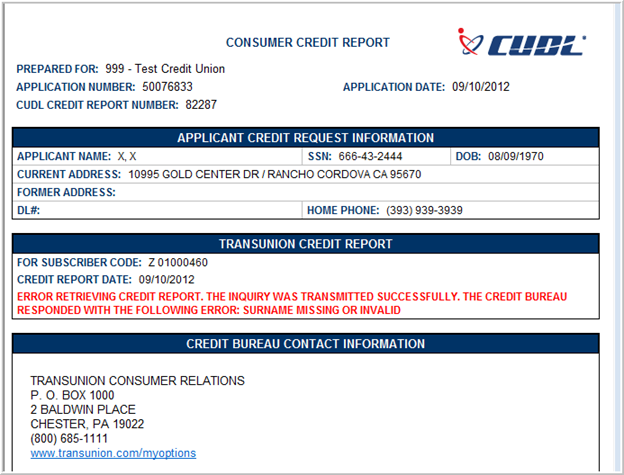

In both CUDL3 and Lending 360, if the credit bureau responds with an error relative to the inquiry data, the error message will be displayed in place of the credit report.

In both CUDL3 and Lending 360, if the credit inquiry results in “no response” from the credit bureau, the credit report form will display with no data.

Page url: https://decision.cudl.com/help/index.html?2012_1.htm