|

|

|

|

|

|

NOTE: Before attempting to configure credit bureau settings, the credit union must have completed the Credit Bureau Subscriber Code Request form for each credit reporting agency being used in the product setup. This form is specific for each credit bureau and provides a list of Decision Manager supported credit bureau score models and other products (such as fraud detection services and OFAC). A copy of this form, for each credit bureau, is included in the Implementation Packet and can also be found on CU Central, under Credit Union Resources, Credit Union Change Forms. Once the forms are completed and signed by the credit union, they are submitted to CU Direct Customer Care for processing. After the subscriber code has been established by the credit bureau, it - along with the associated products - will be made available for selection from the Credit Bureau Setup screen in Decision Manager.

Decision Manager allows for multiple credit reporting agencies to be setup for each loan product. With multiple credit bureau setups completed, you can easily change from one credit bureau to another. And with the option of credit bureau failover, you can select failover triggers that will result in an automated failover process.

The Credit Bureau Setup tab includes global settings and credit bureau specific settings. The global settings are input on the main Credit Bureau Setup screen and apply to the product as a whole. The credit bureau specific settings are input via a pop-up screen and apply specifically to each credit bureau.

The main Credit Bureau Setup screen includes global settings and view only display of the credit bureau specific settings.

Clicking on the "Configure" button for any credit bureau opens the Credit Bureau Specific settings for that credit bureau.

To Complete Credit Bureau Setup

Complete the Global Settings

1. Select the "Primary Credit Bureau". This is the preferred credit bureau report you want used for decision evaluation. With the addition of credit bureau failover, you have the option of setting up a primary credit bureau and up to two failover credit bureaus. See Credit Bureau Failover for further information on this feature.

2. Set your preferred "Number of Days to Reuse Credit Report". This indicates how many days a credit report can be reused on new or resubmitted applications before a new credit report must be pulled. The default is 30 days.

3. Leave "Pull Co-Applicant Credit Report" checked unless you do not want co-applicant credit reports. Uncheck the box to only receive credit reports on the primary applicant.

NOTE: De-selecting this option on an existing product may impact other work areas and require further updates.

4. Indicate whether you will be using Fast Start by checking (or unchecking) "Use Fast Start Score".

Complete the Credit Bureau Specific Settings

5. Select a credit bureau subscriber code from the "Subscriber Code" list. If the subscriber code list is empty or does not include the expected subscriber code, contact CU Direct Customer Care.

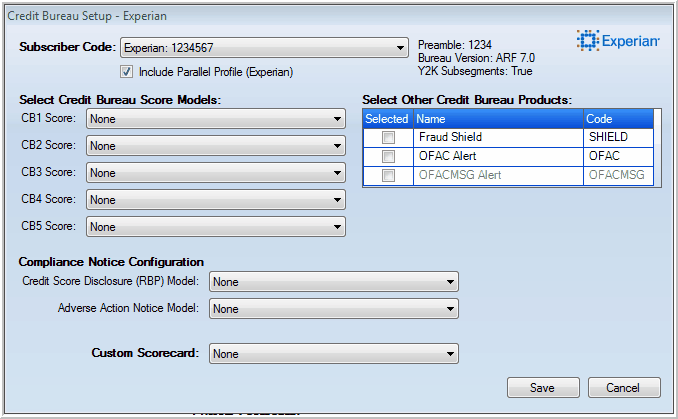

6. You can select up to five credit bureau score models under "Select Credit Bureau Score Models". The model selections are available in picklists identified as CB1 Score, CB2 Score, CB3 Score, CB4 Score, and CB5 Score. Each score model selected will be requested in the credit request. If expected models are not available for selection, contact CU Direct Customer Care.

7. "Select Other Credit Bureau Products". Products that are available for selection will be displayed in black. Click the box in the Selected column to select the product. Grey products that are not selected are unavailable because the Subscriber Code is not configured to support them at the credit bureau. Grey products that are selected are enabled and will be requested with every credit request; they can only be deactivated by contacting CU Direct Customer Care.

8. Select a "Credit Score Disclosure (RBP) Model". Information from the selected model will be available for use in compliance notices generated by lending applications using Decision Manager as the decision engine.

9. Select an "Adverse Action Notice Model". Information from the selected model will be available for use in compliance notices generated by lending applications using Decision Manager as the decision engine.

10. When applicable, select a "Custom Scorecard". This option is only available if your credit union has coordinated with CU Direct to have a custom scorecard setup in Decision Manager.

11. Make sure that the products selected are correct for use in underwriting the product and make any needed changes. Any changes made on this screen affect this product only. If changes are needed to the Subscriber Code setup (i.e. to add a product or score model), contact CU Direct Customer Care.

Page url: https://decision.cudl.com/help/index.html?credit_bureau_setup.htm