|

2011.4.1 |

|

|

|

|

What's New in Decision Manager 2011.4.1?

New Variables

We added three new variables. These variables are available for use in matrices and custom rules. Complete definitions for all variables can be found in the Appendix.

| • | Total Unsecured Balance - Excluding Charge-Offs & Auth User Accounts |

| • | UTI: Total Unsecured Balance - Excluding Charge-Offs & Auth User Accounts/Gross Annual Income |

| • | LTV: Requested Amount/Home Estimated Value |

Decision Manager has two other variables associated with Unsecured Balance that have been available for some time. The other variables are: “Total Unsecured Balance” and “UTI: Total Unsecured Balance/Gross Annual Income”. Unlike the new variables, these variables do not exclude charge-offs or authorized user accounts. If your policy is to exclude these types of accounts, then you may consider updating your products to use the new variables.

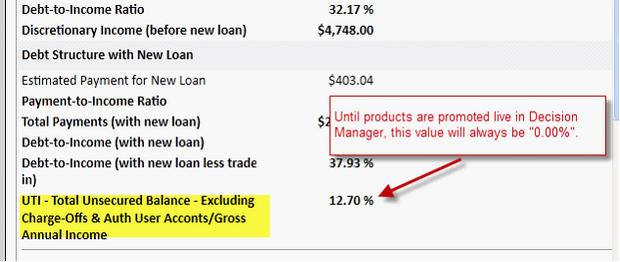

Lending 360 Clients

On the Lending 360 Application Summary, in the Debt Structure, the old variable “UTI: Total Unsecured Balance/Gross Annual Income” is being replaced with the new variable “UTI: Total Unsecured Balance – Excluding Charge-Offs & Auth User Accounts/Gross Annual Income”. Even if you are not using the new variable in a rule or matrix, you still need to promote your products live in Decision Manager in order to get this variable calculated and accurately displayed in Lending 360. Until products are promoted live in Decision Manager, the value for the new variable will always be “0.00%”.

Updated Score Range for Several TransUnion Score Models

TransUnion has recently published new ranges for their score models. In the past, TransUnion published rounded score ranges. Now, they are publishing the actual score range and they have recommended that we use the actual vs. the rounded ranges.

Below is a list of the impacted models showing the old and new range of the score.

Model Name |

Model Code |

|

New Range |

FICO Bankruptcy 03 |

00X46 |

350-900 |

278-901 |

FICO Bankruptcy 98 |

00601 |

350-900 |

338-870 |

FICO Classic 04 |

00P02 |

350-850 |

309-839 |

FICO Classic 08 |

00Q88 |

300-850 |

341-850 |

FICO Classic 95 |

00002 |

336-843 |

403-834 |

FICO Classic Auto 04 |

00P12 |

250-900 |

253-893 |

FICO Classic Auto 95 |

00008 |

250-900 |

312-872 |

FICO Classic Auto 98 |

00990 |

250-900 |

250-854 |

FICO Classic Bankcard 08 |

00N21 |

250-900 |

265-900 |

FICO NextGen 03 |

00R82 |

150-950 |

221-950 |

New Account Model 2.0 |

00R59 |

150-950 |

400-925 |

TransUnion Auto |

00701 |

350-900 |

292-890 |

| • | These changes will automatically impact the score range provided for letter generation. |

| • | If any of your products uses one of the impacted models in matrices or rules, we recommend you promote the product live. This will ensure the full range of the score is evaluated. You should do this even if you are using MIN/MAX to represent the low/high range of the score. |

| • | When you promote, if you have matrices or rules that use a numeric value for the low/high, instead of MIN/MAX, you may receive a validation message like the example below. |

![]()

| • | If this occurs, simply change your low/high to an acceptable value, or use the MIN/MAX, and then complete your promote. |

Page url: https://decision.cudl.com/help/index.html?2011_4_1.htm