What's New in version 2011.1?

The primary focus of Decision Manager 2011.1 is to prepare for the launch of Lending 360, but the enhancements are available to any Decision Manager client.

New Variables

New variables are listed below. Complete definitions for all variables can be found in the Appendix.

| o | Identifies the presence of an Adjustable Rate Mortgage (ARM) Alert |

| o | ARM Alert is a product offered by TransUnion only |

| ► | Auto Repossession Count |

| o | Number of auto trades in repossession status |

| ► | Auto Repossessions with Balance Owing |

| o | Number of auto trades that have a balance greater than 0 and are in repossession status |

| ► | Auto Trades w/Any Delq in Last xx Mos |

| o | Number of auto trades with any delinquency occurring in the last ‘xx’ months |

| o | There are separate variables for last 3, 6, 12, 18, 24, 36, and 48 months |

| o | Number of trades in foreclosure status |

| o | True/False variable to indicate when the Lending 360 loan product being processed is not the loan applied for, but instead, a cross-sell opportunity |

| o | Loan Product Name as defined in Lending 360 |

| o | Number of trades reported as “modified loan” |

| ► | Months at Current + Last Former Address |

| o | Number of months at current address + number of months at last/most recent former address |

| ► | Months at Current + Last Former Job |

| o | Number of months at current job + number of months at last/most recent former job |

| ► | Months at Last Former Address |

| o | Number of months at last/most recent former address |

| ► | Months at Last Former Job |

| o | Number of months at last/most recent former job |

| ► | Ratio of Approved Loan Amount to Gross Monthly Income |

| ► | Total Balance of Medical Collections/Charge-Offs |

| o | Total balance of medical trades that are in charge-off or collection status |

| ► | Total Balance of Non-Medical Collections/Charge-Offs |

| o | Total balance of trades that are in charge-off or collection status and are not medical related |

| o | True/False variable to indicate if a trade-in is included on the application |

| ► | Trades w/Any Delq in Last xx Mos |

| o | Number of trades with any delinquency occurring in the last ‘xx’ months |

| o | There are separate variables for last 3, 6, 12, 18, 24, 36, and 48 months |

| ► | Trades where Max Delq in Last ‘xx’ Mos is Major Derog |

| o | Number of trades where the maximum delinquency that occurred in the last ‘xx’ months is a major derog (90+days delinquent) |

| o | There are separate variables for last 3, 6, 12, 18, 24, 36, and 48 months |

| ► | Trades where Max Delq in Last xx Mos is Minor Derog |

| o | Number of trades where the maximum delinquency that occurred in the last ‘xx’ months is a minor derog (30-60 days delinquent) |

| o | There are separate variables for last 3, 6, 12, 18, 24, 36, and 48 months |

| ► | Trades/Collections Managed by Debt Counseling Service |

| • | Number of trades and collections where payments are managed through a debt counseling service |

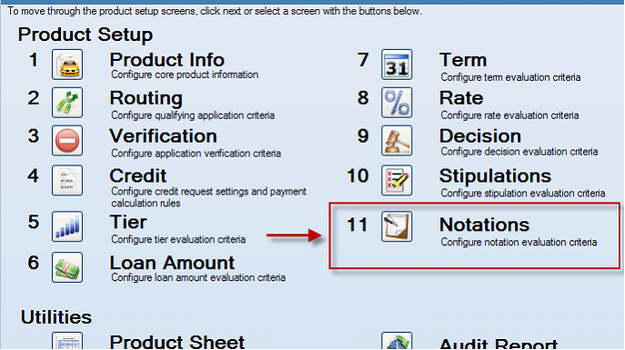

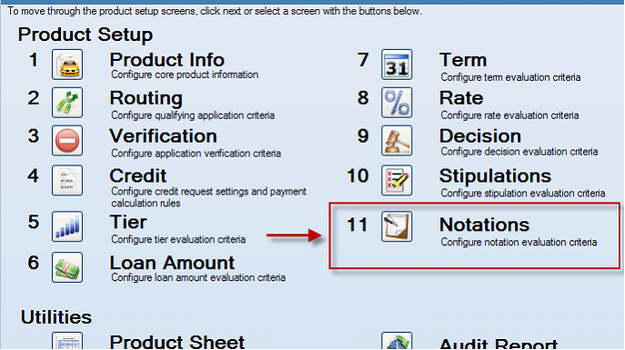

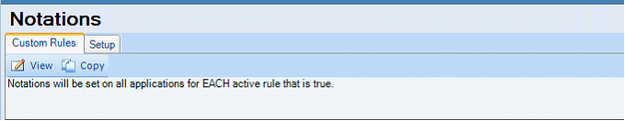

Product Setup Enhancements

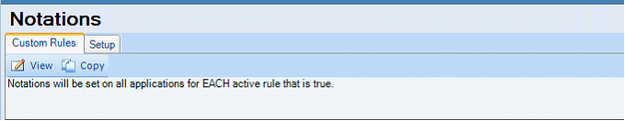

This feature has been added for future use with Lending 360. Although it can be setup in Decision Manager, the design to display Notations is not yet functional in Lending 360. If Notations are set up, regardless of where an application is initiated (Lending 360 or CUDL3), there will be no impact on the application.

When available in Lending 360, Notations can be used to warn of conditions on the application. Notations are for lender’s internal use only. Unlike Stipulations, Notations do not change the decision status.

Product Info

| ► | Loan “Type” has been added to the Product Info screen. Selection for Loan Type can be “Term Loan” (which is the default) or “Revolving Loan”. |

| • | When “Revolving Loan” is selected: |

| ▪ | Term Matrix and Term Custom Rules will be disabled. Any previous input in these areas will be deleted. |

| ▪ | The variable “Approved Term” will not be allowed in the Rate Matrix. |

| ▪ | Promotion of rules using any of the term variables will not be allowed. |

| ► | Payment Calculation Method: “Term Loan” has been relabeled as “Amortization”. The calculation has not changed. |

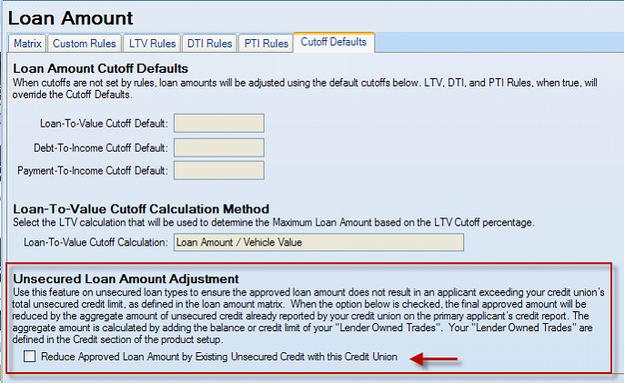

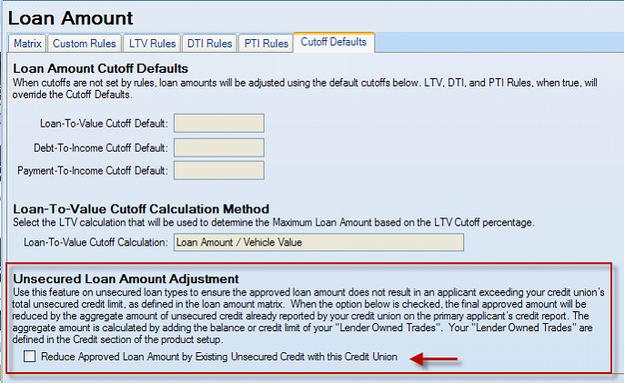

Loan Amount Adjustments

| ► | Unsecured Loan Amount Adjustment: This feature allows lenders to ensure the loan amount does not result in an applicant exceeding their total unsecured credit limit. |

Other Decision Process Changes (these are all specific to applications initiated in Lending 360)

| ► | When application entry does not provide a requested loan amount, assign the maximum qualifying loan amount. |

| ► | When application entry does not provide a requested term for a term loan, assign the maximum qualifying term. |

| ► | Updated calculation of LTV variables to account for not receiving application variables (vehicle value, requested amount, sales price) that are required to complete the calculation. LTV variables will be set to 100% when we receive indicator that the application variable values were not included. |

| ► | Loan Amount > LTV Cutoff: If the application does not include the values required to complete the LTV cutoff calculation, we will bypass the LTV adjustment of the loan amount. The value required in the LTV Cutoff depends on the Loan-To-Value Cutoff Calculation Method. It could be vehicle value or sales price. |

| ► | Re-decisioning: When an application is a re-decision, it retains the original application number, but any application entry changes, Decision Manager product setup changes, and lender applied trade adjustments to monthly payments are applied in the re-decision process. |

| ► | Process Cross-Sell Decisions: Process decision for products other than that submitted. Use all original application data, credit etc…just decision for additional products. Products to cross-sell is determined by setup in Lending 360. |

Page url:

https://decision.cudl.com/help/index.html?2011_1.htm