|

2010.1 |

|

|

|

|

What's New in version 2010.1?

Decision Manager version 2010.1 includes many new variables and several product setup

options. See below for details.

New Variables

New variables are listed below. Complete definitions for all variables can be found in the Appendix.

| • | Experian Risk Models Added |

| o | Bankruptcy PLUS |

| o | Fraud Shield Score PLUS |

| o | Scorex PLUS |

| o | Scorex PLUS2 |

| o | Income Insight |

| • | Trades Opened Last XX Months |

| o | Variables to count the number of trades opened in last 3, 6, 9, 12, 18, 24, 36, and 48 months. |

| • | Auto Trades Opened Last XX Months |

| o | Variables to count the number of auto trades opened in the last 3, 6, 9, 12, 18, 24, 36, and 48 months. |

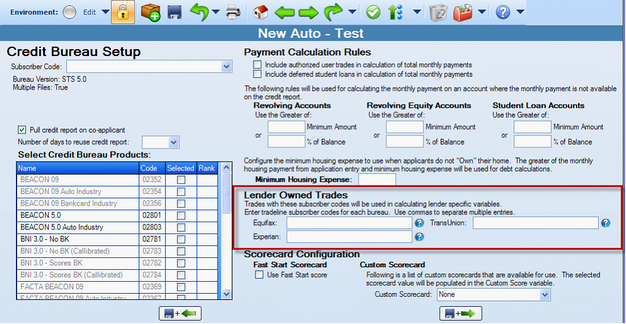

| • | Lender Trades Opened Last XX Months |

| o | Variables to count the number of lender owned trades (as configured in Decision Manager) opened in the last 3, 6, 9, 12, 18, 24, 36, and 48 months |

| • | Lender Total Unsecured Credit |

| o | Calculates the amount of credit extended on unsecured trades where the subscriber code is equal to one setup in the new configuration for lender owned trades. |

| • | Disputed Trade and Collection Count |

| o | Number of trades and collections that are in dispute by the consumer. |

| • | Trade-In Ratios |

| o | Trade-In Ratio: Net Trade-In divided by Vehicle Value |

| o | Trade-In Ratio: (Net Trade-In + Cash Down) divided by Vehicle Value |

| o | Trade-In Ratio: (Net Trade-In + Cash Down + Rebate Amount) divided by Vehicle Value |

| o | Trade-In Ratio: Net Trade-In divided by Vehicle Sales Price |

| o | Trade-In Ratio: (Net Trade-In + Cash Down) divided by Vehicle Sales Price |

| o | Trade-In Ratio: (Net Trade-In + Cash Down + Rebate Amount) divided by Vehicle Sales Price |

| o | Trade-In Ratio: Net Trade-In divided by Approved Loan Amount |

| o | Trade-In Ratio: (Net Trade-In + Cash Down) divided by Approved Loan Amount |

| o | Trade-In Ratio: (Net Trade-In + Cash Down + Rebate Amount) divided by Approved Loan Amount |

Debt Calculation Configurations

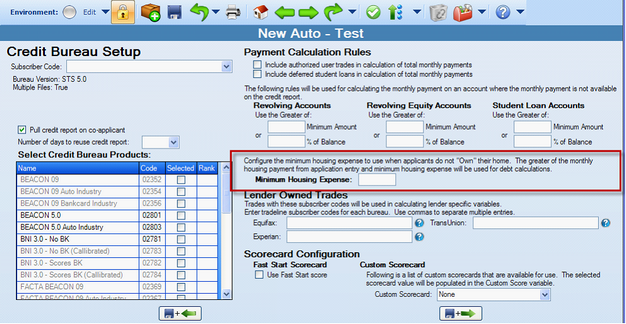

| • | Minimum Housing Expense |

This configuration allows for setup of a minimum housing expense. When an applicant does not own their home, and the housing payment entered on the application entry is less than the minimum housing expense, we will use the minimum housing expense in monthly debt calculations.

Updated method for calculating the Monthly Rent/Mortgage Payments

Calculation of the variable “Monthly Rent/Mortgage Payments” has been updated to consider the minimum housing expense and whether or not the applicant and co-applicant live at the same address.

When calculating the Applicant or Co-Applicant Rent/Mortgage Payments individually:

| ► | If Housing Type is Owns, Monthly Rent/Mortgage Payments = Greater of Monthly Housing Payment from application entry and Monthly Mortgage Payments from the credit report |

| ► | If Housing Type is not Owns, Monthly Rent/Mortgage Payments = the greater of (Monthly Housing Payment from application entry and Minimum Housing Expense) plus Monthly Mortgage Payments from the credit report |

When calculating the combined Rent/Mortgage Payments:

| ► | If Housing Type for both (Applicant and Co-Applicant) is Owns, Monthly Rent/Mortgage Payments = Greater of combined Monthly Housing Payments from application entry and combined Monthly Mortgage Payments from the credit reports |

| ► | If Housing Type for only one subject is Owns, Monthly Rent/Mortgage Payments = Greater of (Monthly Housing Payment from application entry of applicant who Owns and Combined Monthly Mortgage Payments from the credit reports) plus the greater of (Monthly Housing Payment from application entry of applicant who does not Own and Minimum Housing Expense) |

| ► | If Housing Type for both (Applicant and Co-Applicant) is not Owns and addresses match, Monthly Rent/Mortgage Payments = the greater of (Combined Monthly Housing Payment from application entry and Minimum Housing Expense) plus Combined Monthly Mortgage Payments from the credit reports |

| ► | If Housing Type for both (Applicant and Co-Applicant) is not Owns and the addresses do NOT match, Monthly Rent/Mortgage Payments = the greater of (Applicant’s Monthly Housing Payment from application entry and Minimum Housing Expense) plus the greater of (Co-Applicant’s Monthly Housing Payment from application entry and Minimum Housing Expense) plus Combined Monthly Mortgage Payments from the credit reports |

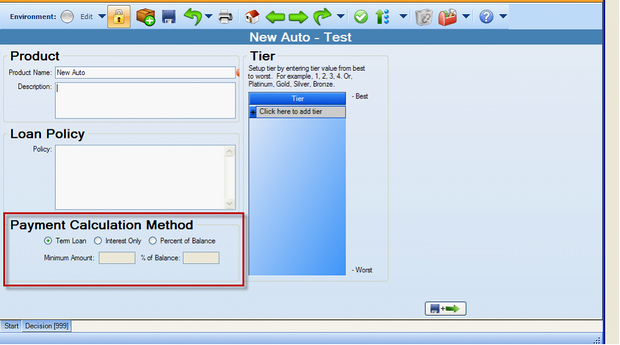

| • | New Loan Payment Calculation Method |

This configuration adds options for determining how the loan payment will be calculated. The default (and current method) is Term Loan. The two new options of “Interest Only” and “Percent of Balance” have been added in preparation for support of the CUDL LOS – Lending 360.

Calculation of the variable “New Loan Payment” has been updated to consider the payment calculation method.

Term Loan (the default method)

((Approved Loan Amount * (Approved Rate/12)) / (1 – (1 + PIR)^(-Approved Term))

PIR = Periodic Interest Rate (APR / # of periods per year)

Interest Only

Max of:

| o | (Approved Loan Amount * Approved Rate) / 12 |

| o | New Loan Calculation Minimum Amt |

Percent of Balance

Max of:

| o | (Approved Loan Amount * % of Balance) |

| o | New Loan Payment Calculation Minimum Amount |

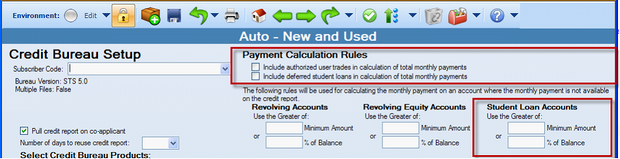

| • | Payment Calculation Rules for Student Loans and Authorized User Trades |

These configurations allow a lender to determine if deferred student loans and authorized user trades will be included in the calculation of total monthly payments.

We have also included rules for calculating the payment on student loans when the monthly payment is not reported on the credit report. The rule for calculating the payment is applicable to any student loan where the payment is not reported, not just deferred student loans.

| o | Default setting for authorized user trades is Yes/checked. By default, these trades are included in monthly debt calculations. |

| o | Default setting for deferred student loans is No/Unchecked. By default, these trades are not included in monthly debt calculations. |

Other Product Setup Enhancements

| • | Configuration of Lender Owned Trades |

These configurations allow lenders to identify their own trades. Trades with the subscriber codes input here will be used in calculating lender specific variables. Lender Total Unsecured Credit and Number of Lender Trades Opened in Last XX Months are the new variables added in this release that work in conjunction with these configurations.

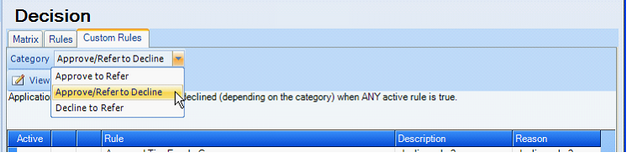

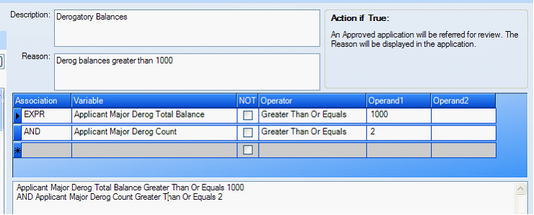

| • | Allow Decline via Decision Custom Rules |

Lenders can setup custom decision rules to automatically decline an application.

| o | Added category “Approve/Refer to Decline”. Applications with a temporary decision of Approve or Refer will be set to Decline when these rules are true. |

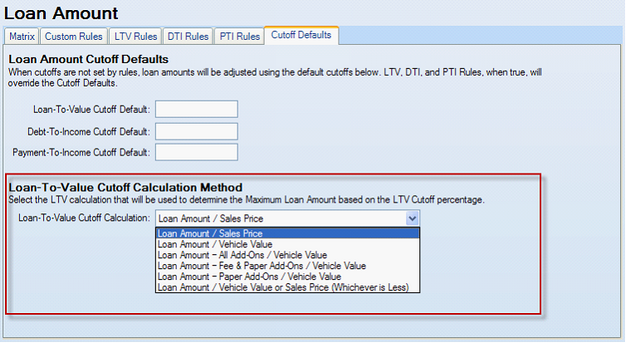

| • | Loan Amount – LTV Adjustments |

We added options for Loan-To-Value cutoff calculation method. This allows selection of the LTV calculation that will be used to determine the maximum loan amount.

| o | The default selection is “Loan Amount / Vehicle Value”. |

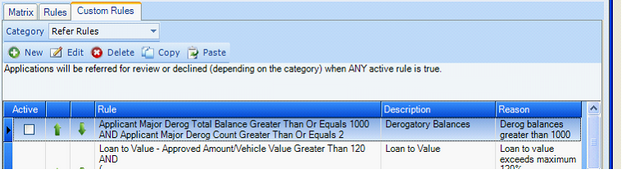

| • | Copy a Custom Rule from One Product to another Product |

This enhancement allows a custom rule to be copied from one product and pasted in the same section of another product. NOTE: Copy of a matrix is already available.

| o | Select a rule |

| o | Click “Copy” button |

| o | Or right click and select Copy |

| o | Navigate to a different product, same section, click paste |

| o | From here, the copied rule can be saved as is, modified, or deleted. |

Security Administration Enhancements

| • | Any user can now update his/her own user information |

A Decision Manager user can now change the following information of their own user account: Title, First Name, and Last Name.

| o | Email cannot be changed. |

| • | New process for unlock and reset of user passwords |

Instead of the old method of the Administrator actually typing in a temporary password for a user who has locked their password, the new process simply has the Administrator send the user an email with instructions on how to reset his/her own password. The user account is automatically unlocked when the password is reset.

| o | When the Administrator clicks “Edit” for a selected user, they then have the option to “Send Password Reset”. |

| o | Below is an example of the email that will get sent to the user. |

From: noreply@cudl.com [mailto:noreply@cudl.com]

Sent: Tuesday, June 29, 2010 1:25 PM

To: Jesus Quizon; Diane Wurm; Jag Gill; James Flammini

Subject: CUDL Password Reset

Please navigate to the following page to reset your password:

https://qa-decision.cudl.com/SingleSignOn/PasswordReset.aspx?authcode=8c65ce271a6b4f199feb0a2df0d3d68c

Note that the link above will expire 1 hour after this email was sent.

If you need additional assistance, please contact your credit union administrator.

It is strongly recommended that you do not use an e-mail account that is shared with another person. If this e-mail account is shared, please request that your credit union administrator modify your user settings to include an e-mail account that is not shared by others.

This e-mail contains confidential information intended only for the recipient. If you are not the intended recipient or believe you have received this communication in error, please notify us at customercare@cudl.com and delete this message from your computer. Any dissemination, distribution or copying of this communication is strictly prohibited and may subject you to criminal or civil penalties.

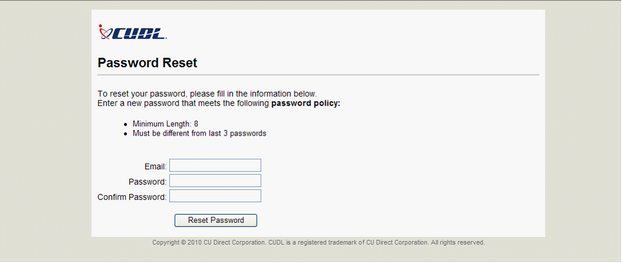

| • | When the user who received the email clicks on the link, this is an example of the Password Reset page they will see. |

| o | This page expires 60 minutes after it was sent. |

| o | This is one time use only; it is no longer valid after a user resets password. |

Plus…

| • | Equifax Identity Scan |

This new Equifax product will replace SafeScan. Equifax has not yet established a retirement date for SafeScan. Contact CUDL Customer Care to have this product activated.

| • | Support of Windows 7 and 64 bit |

| • | Support of Organization Routing for CUSO Lenders |

This allows different CUSO lenders to be routed to the same organization in Decision Manager.

Page url: https://decision.cudl.com/help/index.html?2010_1.htm