What's New in Decision Manager 2013.1?

Multi-Bureau Decisioning

This feature provides options for redecisioning. Initial application decision is always based on credit from the primary credit bureau (with the exception of failover), but with Multi-Bureau Decisioning enabled, the following options are available on redecision:

| • | Redecision using credit from multiple credit bureaus |

| • | Redecision using an alternate single bureau selection |

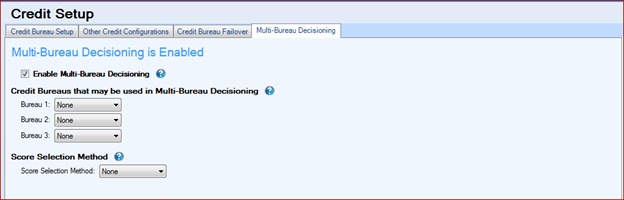

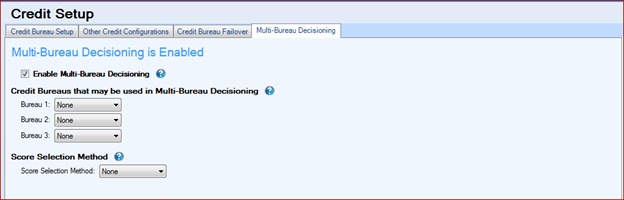

Setup is included in the Credit work area, on a new tab titled Multi-Bureau Decisioning.

To complete setup for Multi-Bureau Decisioning

| 1. | Select “Enable Multi-Bureau Decisioning” |

| 2. | Select the “Credit Bureaus that may be used in Multi-Bureau Decisioning” |

| • | Promote validation will require setup be completed for each credit bureau selected |

| • | Selections here define the “Bureau Order” used in the Score Selection Method |

| • | This selection also determines which credit bureau is used for compliance notices (even when the Score Selection Method is not Bureau Order) |

| 3. | Select a “Score Selection Method” |

| • | For each CB Score variable, determines which of the associated credit bureau scores is used. Applies to CB1-CB5, Fast Start, and some custom scorecards. |

| • | Possible selections are: |

| o | Bureau Order: per applicant, use the first valid score in the order selected under “Credit Bureaus that may be used in Multi-Bureau Decisioning” |

| o | Highest Score: per applicant, use the Highest valid score |

| o | Lowest Score: per applicant, use the Lowest valid score |

In order to use multi-bureau decisioning or alternate single bureau decisioning, the feature must be enabled in the application entry system (Lending 360 or CUDL4). This is done through Administrative Options > General Settings > Loan Application Options in Lending 360/CUDL4.

| • | Enable Credit Bureau Selection: If this option is selected without also selecting “Enable Multi-Bureau Decisioning”, then on redecision, an alternate single credit bureau may be selected |

| • | Enable Multi-Bureau Decisioning: With this option selected, on redecision, one to three credit bureaus may be selected |

Discretionary Income Enhancement

We added an optional feature for applying estimated taxes and estimated living expenses to reduce discretionary income. Setup is found in the Credit work area, on the Other Credit Configurations tab.

The default percentage for taxes and living expenses is 0.00.

| • | Estimated taxes and estimated living expenses are calculated per the lender defined percentage of GMI. The expenses are then applied to the calculation of discretionary income. |

| • | The impacted variables are: |

| o | Discretionary Income before New Loan |

| o | Discretionary Income with New Loan |

| • | A description of the Discretionary Income variables can be found in the Appendix |

New Variables

We added several new variables. These variables are available for use in matrices and custom rules. Complete definitions for these and all variables can be found in the Appendix.

| • | Application has Comments |

| • | Months Since Credit Bureau Current Address First Reported |

| • | Number of Charge-Offs Since BK Discharge |

| • | Open Revolving Trades Opnd Last [xx] Mos - Excluding Auth User Trds |

| o | Separate variables for last 3, 6, 12, 18, 24, 36, and 48 months |

| • | Total Amount of Unpaid Judgments Filed Last [xx] Mos |

| o | Separate variables for last 3, 6, 12, 18, 24, 36, and 48 months |

| • | Total Amount of Unpaid Liens Filed Last [xx] Mos |

| o | Separate variables for last 3, 6, 12, 18, 24, 36, and 48 months |

| • | Total Balance of Medical Collections/Charge-Offs in Last [xx] Mos |

| o | Separate variables for last 3, 6, 12, 18, 24, 36, and 48 months |

| • | Total Balance of Non-Medical Collections/Charge-Offs in Last [xx] Mos |

| o | Separate variables for last 3, 6, 12, 18, 24, 36, and 48 months |

| • | Trades 30 Days Past Due in Last [xx] Mos |

| o | Separate variables for last 3, 6, 12, 18, 24, 36, and 48 months |

| • | Trades 60 Days Past Due in Last [xx] Mos |

| o | Separate variables for last 3, 6, 12, 18, 24, 36, and 48 months |

| • | Trades 90 Days Past Due in Last [xx] Mos |

| o | Separate variables for last 3, 6, 12, 18, 24, 36, and 48 months |

Fast Start Scorecard – GMI Update

Updated the Fast Start scorecard characteristic “Total Gross Monthly Income” to assign points per 2012 dollar values. (2012 is the most recent update.)

Credit Engine Version 2

| • | In support of multi-bureau decisioning options and other application channels, we’ve upgraded the credit engine to parse credit data and calculate variables up to 60 times faster |

| • | Added ability to send freeze lift PIN in credit inquiries |

| o | Input of PIN is available in Lending 360 and CUDL4 |

| o | Updated to display multi-bureau merged credit reports |

| o | Added “Date of 1st Delinquency” to Equifax Collections |

| o | On combined view (applicant and co-applicant), added indicator “BOTH” to trades/public records/collections when found on credit report of applicant and co-applicant |

Fixed Defects

| • | Duplicate Trades (defect 5554): Some non-duplicate trades were being flagged as duplicates and therefore excluded from debt calculations |

Page url:

https://decision.cudl.com/help/index.html?2013_1.htm