|

|

|

|

|

|

Verification is an option that can screen applications prior to requesting a credit report and automatically decline, refer, or approve those that meet certain exception criteria. This can reduce unneeded credit reports from being pulled on applications (a) that the lender cannot or will not accept or (b) for non-member applicants that do not qualify for membership.

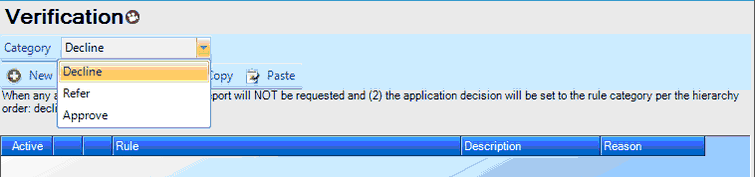

Verification Rule Category

On the Verification screen, use the Category picklist to create rules that will the will decline, refer, or approve. You can setup rules for all three categories; if rules are true in multiple categories, the application decision will be set to the rule category per the hierarchy order: decline, refer, approve.

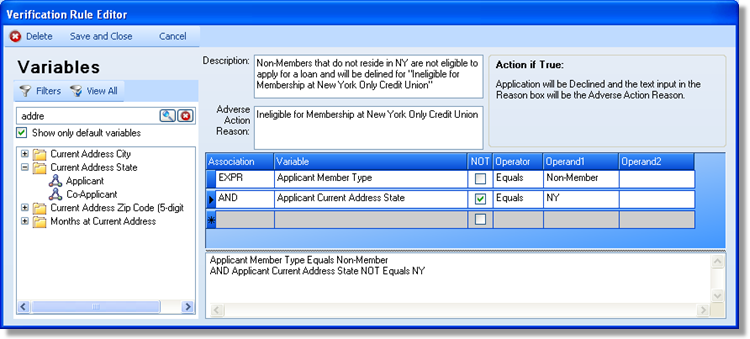

Verification Rule Editor

The Verification Rule Editor is used to create Custom Rules using application variables to automatically set a decision for an application without pulling a credit report. (Credit variables such as credit scores or trade counts cannot be used because credit has not been pulled.)

1. Use the Description field to document the type of application(s) to be rejected without pulling credit.

2. Complete the "Reason" field for the Adverse Action Reason (for a decline rule), Referral Reason (for a refer rule), or Reason (for an approve rule).

3. In the Adverse Action Reason field, enter the exact wording that should appear on an adverse action notice. The text entered here will be the decline reason for this application.

4. In the Referral Reason field, enter the exact wording that should appear as a referral reason. The text entered here will be displayed in the decision referral reasons for this application.

5. The Reason field on an approve rule is not displayed, but is still required input.

6. Click and drag a variable to build a custom rule that defines applications that should be automatically decisioned by verification rules only and without pulling credit.

For additional information, see Custom Rule Editors.

Page url: https://decision.cudl.com/help/index.html?verification.htm