|

|

|

|

|

|

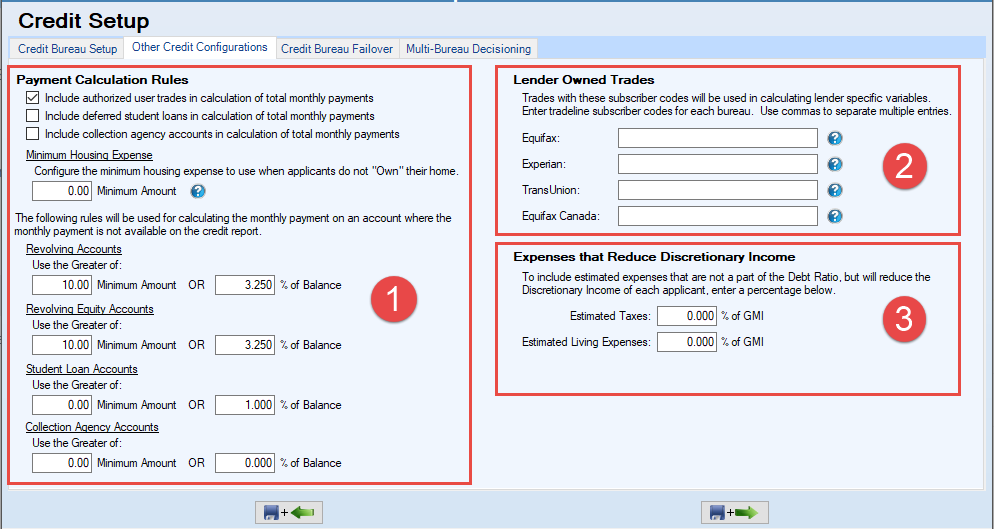

Decision Manager offers several options for configuring debt calculations.

1 - Payment Calculation Rules

Provides flexibility in determining how to handle authorized user trades, deferred student loans, collection agency accounts, minimum housing expense, and trades on the credit report that have a balance, but do not have a monthly payment.

Include Authorized User Trades in Calculation of Total Monthly Payments

By default this option is ON and results in authorized user trades being included in the calculation of total monthly payments. To change the setting, click on the checkbox. When checked, the option is ON. When unchecked, the option is OFF.

Include Deferred Student Loans in Calculation of Total Monthly Payments

By default this option is OFF and deferred student loans are not included in the calculation of total monthly payments. To change the setting, click on the checkbox. When checked, the option is ON. When unchecked, the option is OFF.

Include Collection Agency Accounts in Calculation of Total Monthly Payments

By default this option is OFF and collection agency accounts are not included in the calculation of total monthly payments. To change the setting, click the checkbox. When checked the option is ON. When unchecked, the option is OFF.

| • | The term "Collection Agency Accounts" refers to accounts reported by third party collection agencies, not tradelines in collection status. |

| • | If this option is turned ON, be sure to input values other than 0.00 for Minimum Amount OR 5% of Balance. |

Minimum Housing Expense

For applicants who do not "Own", use this configuration to set the minimum dollar amount for monthly housing expense. When calculating the Monthly Rent/Mortgage Payments for applicants who do not Own, Decision Manager will use the greater of the application entry monthly housing payment and the product setup minimum housing expense.

Rules for calculating the monthly payment on trades that have a balance, but do not have a monthly payment reported:

Revolving Accounts

Examples of a revolving accounts are credit cards and unsecured/personal lines of credit. Decision Manager will use the greater of the Minimum Amount or the Percentage of the Balance indicated when these trades report a balance, but no payment amount.

Minimum Amount: The default setting is $10.00. To disable this feature, enter 0.

% of Balance: The default setting is 3.25%. To disable this feature, enter 0.

Revolving Equity Accounts

An example of a revolving equity account is a Home Equity Line of Credit (HELOC).

Minimum Amount: The default setting is $10.00. To disable this feature, enter 0.

% of Balance: The default setting is 3.25%. To disable this feature, enter 0.

Student Loan Accounts

Minimum Amount: The default setting is $0.00.

% of Balance: The default setting is 1.00%. To disable this feature, enter 0.

Collection Agency Accounts

Minimum Amount: The default setting is $0.00.

% of Balance: The default setting is 0.00%.

To complete the setup, enter a value greater than 0.00 for at least one of the options above.

2 - Lender Owned Trades

Decision Manager offers several variables that do calculations of tradelines reported to the credit bureaus by your credit union. In order for Decision Manager to complete the calculations using your "Lender Owned Trades", you must provide the subscriber codes you want Decision Manager to use in those calculations.

3 - Expenses that Reduce Discretionary Income

Estimated Taxes and Estimated Living Expenses are calculated per the lender defined percentage of GMI. These configurable expenses will reduce the discretionary income variables. The default value for both estimated expenses is 0.00

Page url: https://decision.cudl.com/help/index.html?payment_calculation_rules.htm